Entering the forex market can feel overwhelming for new traders. This listicle provides seven actionable forex trading strategies for beginners. These strategies provide a solid foundation for understanding market mechanics and making smarter trading decisions. We'll explore setup tips, risk management, and examples using EzAlgo tools to enhance your approach.

Forex trading strategies are essential for beginners because they provide a structured framework for analyzing the market and executing trades. Without a clear strategy, trading can quickly become chaotic and lead to significant losses. These strategies will help you identify potential trading opportunities, manage risk effectively, and improve your overall trading performance.

This guide provides clear, actionable steps, avoiding complex jargon. Each strategy is explained with practical examples and EzAlgo integration, empowering you to apply these techniques immediately. We emphasize risk management throughout, a crucial element of successful forex trading.

Specifically, we'll cover these key forex trading strategies:

This listicle equips you with the knowledge and tools to confidently navigate the complexities of forex. Whether you're a complete novice or have some trading experience, these strategies will help you refine your approach and improve your trading outcomes. Let's dive in!

For beginner forex trading strategies, trend following stands out as a robust and time-tested approach. This strategy centers around identifying the prevailing market trend and trading in its direction. It operates on the simple yet powerful principle: "the trend is your friend." By capitalizing on established momentum, traders aim to ride the wave of price movements, maximizing potential gains. Instead of predicting market turning points, trend followers simply aim to join the existing flow. This strategy is particularly well-suited for beginners as it provides a clear framework for analyzing markets and making trading decisions.

Trend following involves analyzing price charts to determine the current market direction – uptrend, downtrend, or sideways. Traders typically employ technical indicators like moving averages, trendlines, and momentum oscillators to confirm the trend's presence and strength. Once a trend is identified, traders enter positions aligned with it. In an uptrend, they buy, anticipating further price increases. Conversely, in a downtrend, they sell, expecting further declines.

History offers numerous examples of successful trend following. The EUR/USD downtrend from 2014-2015, driven by ECB quantitative easing, provided ample opportunities for short sellers. Similarly, the GBP's decline during the Brexit uncertainty of 2016-2019 presented sustained downtrends in various GBP pairs. Conversely, the USD/JPY experienced a strong uptrend during US interest rate hiking cycles, rewarding traders who identified and followed the upward momentum. These real-world scenarios demonstrate the potential profitability of aligning trades with prevailing market forces.

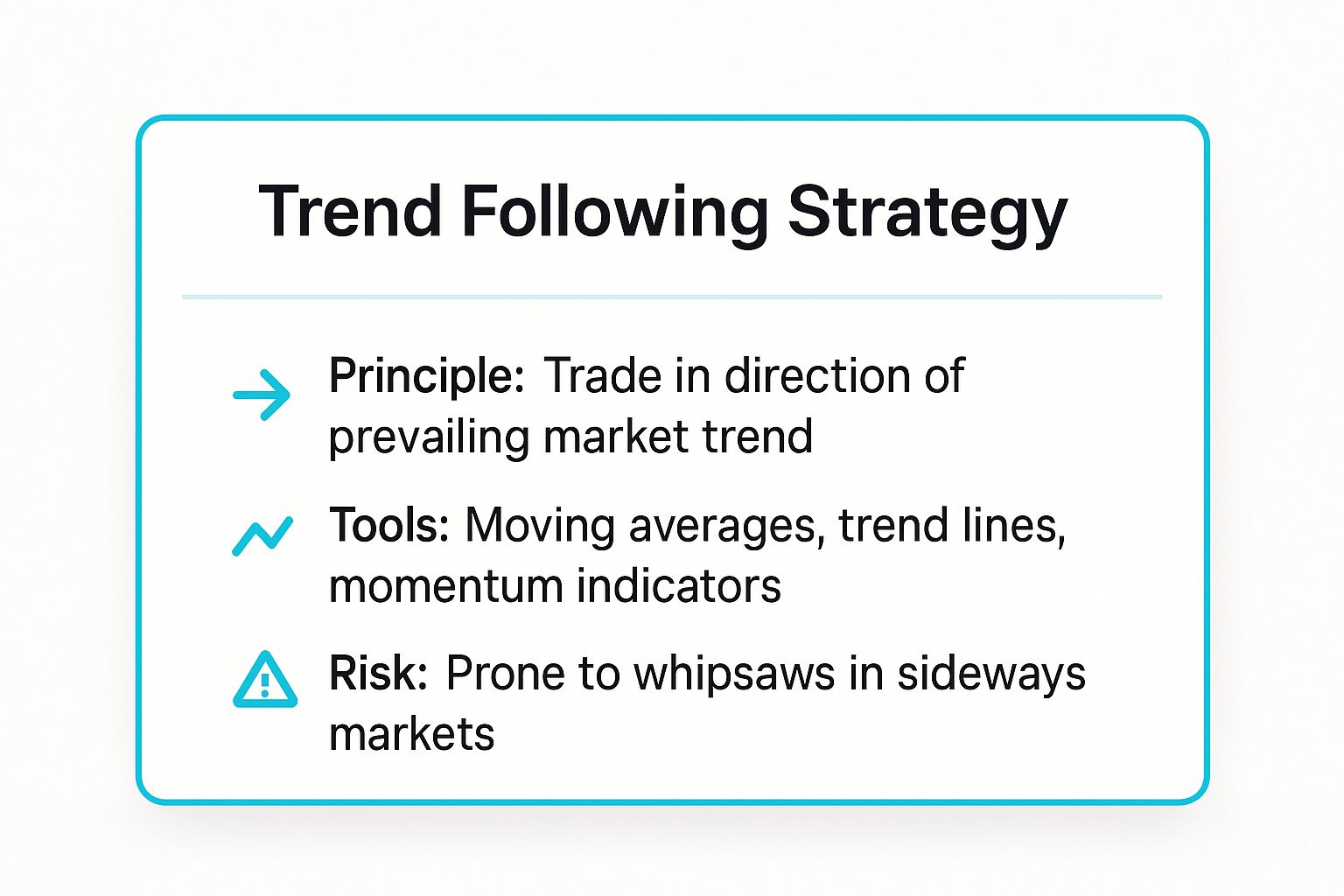

The following infographic summarizes the core principles of trend following:

This quick reference highlights the core elements of a trend-following strategy - identifying the current trend, using appropriate tools like moving averages and trendlines, and acknowledging the inherent risk of whipsaws in sideways markets. As the infographic reveals, trend following allows you to ride existing market momentum, but careful attention to market conditions is necessary to avoid losses during periods of consolidation.

To effectively implement trend following in forex trading for beginners, consider these tips:

By adhering to these practical guidelines, beginner traders can leverage the power of trend following while effectively managing risk. Trend following offers a structured and systematic approach to navigating the forex market.

For beginner forex trading strategies, support and resistance trading offers a straightforward yet powerful approach. This strategy revolves around identifying key price levels where a currency pair has historically struggled to break through (resistance) or has found consistent buying interest (support). Traders capitalize on these levels by buying near support, anticipating a price bounce, and selling near resistance, expecting a price reversal. These levels often become self-fulfilling prophecies as many traders actively watch and react to them. This makes support and resistance a crucial concept for forex trading strategies for beginners.

Support and resistance levels can be identified using various methods. Horizontal lines drawn across previous highs and lows are a common starting point. Trendlines, moving averages, and Fibonacci retracement levels can also serve as dynamic support and resistance zones. Once these levels are identified, traders look for price action confirmation before entering trades. For instance, a bullish candlestick pattern forming near a support level could signal a buying opportunity.

The forex market offers numerous examples of support and resistance in action. The EUR/USD pair found strong support around the 1.2000 level in 2020-2021, repeatedly bouncing off this level before eventually breaking higher. Conversely, the GBP/USD faced significant resistance at the 1.3000 level in 2022, with multiple attempts to break above this level failing. The USD/JPY's 110.00 level has historically acted as both support and resistance, highlighting how these levels can shift over time.

To effectively implement support and resistance trading, beginners should consider these practical tips:

By following these guidelines, beginner forex traders can effectively utilize support and resistance levels to identify high-probability trading opportunities and manage risk. Support and resistance trading provides a practical and versatile framework for navigating the complexities of the forex market.

For beginner forex trading strategies, the moving average crossover strategy offers a systematic and visual approach to identifying potential buy and sell signals. This strategy utilizes two or more moving averages of different periods, plotted on a price chart. The crossover points of these moving averages serve as the basis for trading decisions. This method helps smooth out price fluctuations and can provide early indications of trend changes.

The core concept is simple: a faster moving average (e.g., 50-period) crossing above a slower moving average (e.g., 200-period) suggests increasing bullish momentum and generates a buy signal. Conversely, when the faster moving average crosses below the slower one, it signals potential bearish momentum, triggering a sell signal. This visual representation of trend shifts helps traders identify potential entry and exit points. You can learn more about backtesting trading strategies, like the moving average crossover strategy, by checking our detailed guide on the EzAlgo blog: Learn more about backtesting trading strategies.

History provides numerous examples of successful moving average crossover implementations. For instance, a 50-day exponential moving average (EMA) crossing above a 200-day EMA on the EUR/USD pair has historically signaled the start of multi-month uptrends. Similarly, observing a 20-period simple moving average (SMA) crossing below a 50-period SMA on GBP/JPY could indicate a developing downtrend. Even the widely-used Moving Average Convergence Divergence (MACD) indicator incorporates a crossover strategy, combining moving average crossovers with price action analysis.

Implementing the moving average crossover strategy effectively requires careful consideration of several factors:

By following these practical tips, beginner traders can leverage the simplicity and effectiveness of the moving average crossover strategy while managing risk. This approach offers a clear framework for identifying potential trading opportunities based on trend changes.

For beginner forex trading strategies, range trading, also known as channel trading, offers a structured approach to profiting from sideways market movements. This strategy capitalizes on currency pairs trading within established price ranges or channels. Traders buy at the bottom of the range (support) and sell at the top (resistance), profiting from the oscillating price movement. This strategy works best in stable market conditions without strong directional trends, making it ideal for beginners learning to identify and trade within defined boundaries.

Range trading involves identifying support and resistance levels that define the boundaries of a trading range. Traders use technical analysis tools like horizontal trendlines, Fibonacci retracements, and pivot points to pinpoint these crucial levels. Once the range is identified, traders buy near the support level, anticipating a bounce back towards resistance. Conversely, they sell short near the resistance level, expecting a pullback towards support.

Several currency pairs frequently exhibit range-bound behavior, providing opportunities for range traders. The EUR/GBP, for instance, has historically traded within defined ranges for extended periods. Similarly, during times of economic uncertainty, pairs like the AUD/USD can oscillate between established support and resistance levels. These real-world examples demonstrate the potential profitability of capitalizing on range-bound market conditions. Forex trading strategies for beginners often highlight range trading as a viable approach, especially during periods of market consolidation.

To effectively implement range trading in forex trading for beginners, consider these tips:

By following these practical guidelines, beginners can effectively navigate range-bound markets and enhance their trading performance. Range trading offers a clear framework for identifying opportunities and managing risk in consolidating markets.

For beginner forex trading strategies, breakout trading offers a compelling approach centered on identifying and capitalizing on significant price movements. This strategy involves entering positions when the price breaks through established support or resistance levels, signaling a potential shift in market sentiment and the start of a new trend or an extension of an existing one. Breakout traders anticipate that this momentum will continue, propelling the price further in the direction of the breakout.

Breakouts occur when the price decisively moves beyond a pre-defined support or resistance level. Support represents a price level where buying pressure is expected to overcome selling pressure, preventing further price declines. Resistance, conversely, is a price level where selling pressure is expected to outweigh buying pressure, preventing further price increases. A breakout trader identifies these key levels using technical analysis tools like trendlines, horizontal support/resistance, and moving averages. Learn more about...

Several historical examples illustrate the effectiveness of breakout trading in forex. The EUR/USD breaking above the 1.2000 resistance level led to a sustained rally, rewarding traders who anticipated the breakout. Conversely, the GBP/USD breaking below the 1.2000 support level during Brexit negotiations offered significant opportunities for short sellers. Similarly, the USD/JPY breaking above key resistance at quarterly highs signaled strong upward momentum. These real-world scenarios demonstrate the potential of capitalizing on decisive price movements through breakout trading.

For beginners exploring forex trading strategies, implementing breakout trading requires careful planning and risk management. Consider these essential tips:

By incorporating these practical tips, beginner traders can enhance their breakout trading strategy, improving their chances of success in the forex market. Breakout trading provides a structured approach to identifying and capitalizing on potential trend shifts.

For beginner forex trading strategies, the carry trade offers a unique approach centered around exploiting interest rate differentials between currencies. This strategy involves buying a currency with a higher interest rate and simultaneously selling a currency with a lower interest rate. The profit comes from the "carry," which is the difference between these interest rates. This daily interest earned can accumulate significantly over time, especially when combined with favorable currency movements. The carry trade is particularly appealing to beginners seeking a fundamental-based trading strategy.

The core principle behind the carry trade lies in capitalizing on interest rate disparities. For example, if the Australian dollar (AUD) has a significantly higher interest rate than the Japanese yen (JPY), a trader would buy AUD/JPY. By holding this position, the trader earns the interest rate differential between the AUD and JPY. This daily interest accrual forms the basis of the carry trade's profitability.

Several historical examples highlight the potential of the carry trade. The AUD/JPY carry trade became incredibly popular during the 2000s commodity boom, fueled by Australia's high interest rates. Similarly, NZD/JPY trades were favored during periods of New Zealand rate hiking cycles. Even more dramatically, the USD/TRY carry trade, involving the Turkish Lira, attracted significant interest during periods when Turkey offered exceptionally high yields, though this also carried substantial risk. These examples demonstrate the carry trade's historical relevance in forex trading strategies for beginners.

While lucrative, the carry trade isn't without risks. Major central bank policy shifts can drastically alter interest rate differentials, impacting profitability. Therefore, diligently monitoring central bank announcements and economic indicators is crucial.

To successfully implement the carry trade strategy, consider these tips:

By adhering to these practical guidelines, beginner forex traders can implement carry trade strategies while effectively managing inherent risks. The carry trade offers a distinctive approach within forex trading for beginners, leveraging fundamental economic factors for potential profit.

For beginner forex trading strategies, price action trading offers a compelling approach centered on interpreting raw price movements. This strategy involves analyzing candlestick patterns, chart formations, and support/resistance levels to anticipate future price direction. Unlike indicator-based strategies, price action focuses solely on the market's inherent behavior, reflecting the underlying forces of supply and demand. By understanding how price has moved in the past, traders aim to predict how it might move in the future. This method eliminates the need for complex indicators, simplifying chart analysis and allowing for a more direct interpretation of market sentiment.

Price action trading involves recognizing recurring patterns in price charts. These patterns, such as pin bars, inside bars, and engulfing patterns, often signal potential reversals or continuations. Traders look for these patterns at key support and resistance levels to increase their probability of success. For example, a pin bar rejection at a strong support level might suggest a potential bullish reversal. Conversely, an engulfing pattern following a breakdown of support could signal a continuation of the downtrend.

Successful price action trading hinges on correctly interpreting chart patterns. Consider a scenario where the EUR/USD forms an inside bar after a significant upward move. A breakout above the high of the inside bar could signal a continuation of the uptrend, providing a buy entry point. Similarly, a pin bar forming at a major resistance level on the GBP/JPY chart could indicate a potential shorting opportunity. These real-world scenarios illustrate how price action signals can provide actionable trading opportunities in forex trading for beginners.

To effectively implement price action trading, beginners should consider these tips:

By following these practical guidelines, beginner traders can develop the skills necessary to effectively interpret price action and navigate the forex market. Price action trading offers a direct and intuitive approach to understanding market dynamics, empowering traders to make informed decisions based on raw price data.

This guide has explored several powerful forex trading strategies for beginners, each designed to equip you with the tools and knowledge necessary to navigate the dynamic forex market. We've covered core concepts like trend following, support and resistance, moving average crossovers, range trading, breakout trading, carry trades, and price action trading. Mastering these strategies provides a solid foundation for your trading journey, enabling you to identify opportunities, manage risk, and confidently approach the market.

Let's recap the essential takeaways:

These strategies, while powerful on their own, become even more effective when combined with the right tools. Imagine having access to real-time alerts for potential setups, AI-driven insights into market momentum, and customized indicators that align with your specific strategy.

Mastering these forex trading strategies for beginners allows you to move beyond simple guessing and develop a systematic approach to the market. This empowers you to make informed trading decisions, manage risk effectively, and potentially increase your profitability. Remember, consistent application and continuous learning are key to achieving your trading goals. By combining proven strategies with the advanced capabilities of EzAlgo, you gain a significant advantage in the forex market.

Ready to take your forex trading to the next level? EzAlgo provides AI-powered tools, real-time alerts, and advanced indicators specifically designed to enhance your trading strategies. Visit EzAlgo today and discover how you can leverage the power of AI to unlock your full trading potential.